While the cycling industry and consumers are reverberating from the Stages apparently laying off their entire workforce last weekend, the reality is that the Stages story is far from over. And equally, it was far from starting this past weekend. As Stages product owners know quite well, the company had seemingly been on life support for the last year, visible to both consumers and industry watchers alike.

This follows nearly a year of continued degradation of their product support responsiveness, and loss of key long-term leaders at the company. Product support answering times over the last year seemed to extend outwards to months (if ever), even for high-end smart bike products. Finally, the last nail in the situation is that the entire Stages site now shows all products as out of stock. And that sets aside the $14M that the company apparently owes Giant Cycling (more on that in a second).

All signs are pointing towards Stages having just gone out of business, even if they aren’t prepared to admit that unfortunate reality quite yet (they haven’t seemingly responded to any media outlet). But once you lay off all your staff and stop selling products, it’s hard to consider oneself an operating business entity.

Still, countless businesses have risen from the ashes, either as a slimmed-down version of themselves or, as an acquisition by another company. Stages do have valuable assets, but those assets aren’t quite as valuable as they would have been a few years ago. Let’s dive into why – and what it might mean for consumers.

Stages Product Portfolio

(Image credit: Stages Cycling)

To some, they might think that Stages was a small company without much experience in the cycling world. When in reality, they have been market leaders and innovators in many segments for quite some time. They were just doing it in segments that weren’t super sexy.

Stages were first known for their indoor cycling bikes under Foundation Fitness (what many would call ‘Spin bikes’, though technically speaking ‘Spin’ bikes are actually a trademarked thing from Spinning). Still, they sold high-end indoor bikes to gyms around the world. The company says they generate more than 110 million rides per year (many of these bikes are internet connected devices, which actually send data back to Stages and their operators). For a long time, Stages made more indoor bikes than anyone else in the world (by a massive margin). The numbers Stages put together dwarfed companies like Wahoo, Garmin/Tacx, and others. However, Peloton’s continued bike sales has likely brought them pretty close to that same ballpark.

Stages main product for the Zwift-era was the Stages SB20 bike, announced in 2019 and available in 2020. The beast tank of a bike had great road feel, and included really good technical connectivity. It had a dual-sided power meter in it (versus a calculated value used in most bikes), and they had great support for things like triathlon bar extensions and more. When Stages developed the bike though, they leaned heavily on their existing commercial designs. These designs were incredibly robust, and designed for high-usage in gyms. But in a consumer setting, they were overkill. That overkill meant a very heavy bike (to ship, far heavier than their competitors). That also meant significantly reduced margins when it came to distribution of that bike, due to the higher shipping costs. So while they skipped over many of the reliability issues their competitors such as Wahoo dealt with, they paid the price in much higher distribution costs. Additionally, for whatever reason, the bike was never able to command the premium pricing that their competitors Wahoo & Garmin/Tacx were able to get, likely due to a lack of specialty features like simulated gradient control (rising bike up/down).

But Stages real break-out product in the cycling consumer market was actually their single-sided power meter, back in 2012. At the time, the concept was new, and totally unheard of. Previously, all other crankset power meters had been placed in other locations like the crank spider, rather than the crank arm itself. When Stages came onto the scene, they offered a bargain-priced power meter, but paired that with sponsoring Team Sky in 2014 in the Bradley Wiggins and Chris Froome Era. Given the low price they paid, it was unquestionably one of the greatest sports tech sponsorship deals in history.

While there were (and still are) challenges with single-sided power meters, it was the best marketing strategy one could ever dream of. How can the average consumer argue with “Well, if it’s good enough for a Chris Froome & Bradley Wiggins, then it’s good enough for me.”. Of course, in the end, it actually wasn’t good enough for Team Sky. Per Stages own media briefing at the launch of their dual-sided Stages LR in 2014 (standing for left/right), Stages noted that the requirement came from Team Sky for greater accuracy levels. Tim Kerrison, who was ‘Head of Performance’ for Team Sky, said of asking for a left/right version:

“We wanted to make sure we weren’t missing anything.”

The new dual-sided version was actually quite accurate, even if it wasn’t likely Stages most popular product. Rather, the single-sided units undoubtedly remained their best seller, given the lower price.

Of course, countless other companies followed in Stages footsteps here, ultimately making their single-sided product idea relatively commonplace in the industry. There wasn’t much that Stages could offer from a uniqueness standpoint, aside from increasing various specific crankset compatibility options. But everyone else was doing that too.

The last main product Stages product set Stages produces was their Dash bike computers. These units leaned very tech-heavy in terms of features, and were arguably some of the most deeply power-focused products on the market. Stages had incredibly deep structured training integration, including that with the recently shuttered Today’s Plan platform, as well as a similarly deep ability to customize the layout and features of the Stages Dash units. The company generated a few different models of these, in various sizes, over a time span starting in 2016.

Stages eventually created a partnership with Giant Cycling in 2022, which includes variants of the Stages Dash M200 and L200 that were simply re-branded as Giant Cycling versions. They were otherwise identical.

The challenge though is that while the Stages Dash units were very strong from a power meter integration and structured workout standpoint, they lacked many of the other consumer-focused features that people wanted at the time. Features akin to Garmin’s ClimbPro, or Strava Live Segments, or full mapping and navigation wouldn’t come till well after their competitors (if ever). And that sets aside the somewhat chunky looking visual appearance. Popularity never caught on like their power meters did.

Giant & Stages: An Intertwined Relationship

Stages and Giant shared a very intertwined relationship, with Giant manufacturing much of Stages’ product portfolio, especially on the indoor bike and bike component side. Of course, while many consumers know Giant as a maker of various cycling products – the reality is Giant manufactures countless other cycling industry brands products as well. For example, years ago, Giant was the manufacturing partner for the original Wahoo KICKR smart trainers.

But on the Stages front, within cycling industry circles, the news has been swirling around the drain for months. Aside from the customer service team being gutted last year (and as a result, customer service response times), the company lost one of their key leaders, Pat Warner, earlier this year to Giant. He resigned from Stages to become VP of Product R&D at Giant Cycling. Stages and Giant had previously moved towards deeper partnerships, including Giant announcing a $20M investment in Stages Cycling. However, Giant later called off the investment, undoubtedly leaving Stages in a precarious position given it was just at the start of the downfall of many companies in the indoor cycling industry.

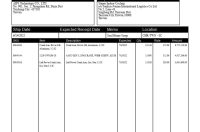

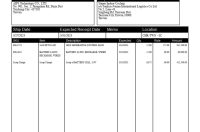

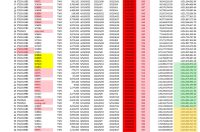

Adding fuel to the fire, Stages Cycling was sued by Giant back in February, a nugget found by Bicycle Retailer earlier this week. Giant alleges that Stages owes them some $13.9m USD for products that Giant manufactured for Stages.

In looking at the lawsuit, Giant (technically their US subsidiary AIPS), lists all the components for which Stages still has outstanding payments on. It’s almost entirely high-end indoor cycling bikes and studio setups, numbering in the hundreds, as well as scrap and other charges. For funnsies (because everyone loves a good set of purchase order documents), I’ve pulled those documents out of the lawsuit, and put them in this gallery. This is the complete set of invoices that Giant alledges Stages still owes them.

Now going back to the lead players in this saga, Pat Warner was not the only person to leave Stages to join Giant. Stages’ former VP of Global Marketing, Paddy Murray, and two Stages engineers – Eric Golesh and Andy Lull also moved over to Giant. Paddy Murray became Giant’s VP of Global Sales and Marketing.

In a post on LinkedIn, Paddy Murray a month ago announced his move to Giant, saying:

“I am really excited to announce that I have embarked on a new chapter of my career by joining the Giant Group, the world’s leader in cycling innovation and manufacturing (They’ve actually manufactured every bike that I’ve been involved with since I joined the industry)! In my new capacity as VP Global Sales and Marketing, I’ll be spearheading the launch of a groundbreaking indoor cycling division SPIA Inc, reuniting with some of the most brilliant product and engineering minds in the bicycle and fitness industry, Pat Warner, Eric Golesh, & Andy Lull. It’s truly a special opportunity, and I can’t wait to dive in and bring our innovative plans to life!

Reflecting on the journey that led me here, I feel immense gratitude for my time at Stages. Working alongside some truly inspiring colleagues, partners, customers, and together we innovated and built something special. We shared unforgettable experiences and smashed our own expectations and many in the global indoor cycling and power meter worlds. The memories of our adventures across the globe bring a huge grin to my face, and I’m incredibly proud to have played a small part in shaking up this little industry we play in.”

A quick run-through of those names, Eric Golesh was at Stages (technically Foundation Fitness) from 2010 till Feb 2024, as the “Product Development Director”, prior to that he was an Engineering Manager and Senior Mechanical Engineer at Nautilus for 8 years. Meanwhile, Andy Lull was a Product Development Manager at Stages, and is now a Principal R&D Engineer at Giant. Again, remember that Giant manufactured virtually all of Stages’ indoor bikes – thus seeming to be in a prime position to continue those sorts of products going forward.

What Happens Next?

At this moment, it does not yet appear that Stages Cycling has filed for bankruptcy protection. Essentially, they’ve seemingly laid off everyone and have a two—month old lawsuit filed against them. So while they don’t appear to be meaningfully operating the business, behind the scenes there’s unquestionably quite a bit going on from a financial standpoint.

Seemingly, this can basically end one of three ways:

A) Stages receives an investment via fundraising (or buying a PowerBall ticket) to continue operating as Stages Cycling/Foundation Fitness.

B) Stages files for bankruptcy protection, and then goes through that process to whatever extent the courts and creditors allow

C) Stages becomes acquired by another entity, to be absorbed by that entity

Had this been 3-4 years ago, the first option to receive investment would have been an easy option. Investors for indoor cycling were plentiful, and willing to pay (and overpay) for just about anything. But those days are long gone. While investment funding is on the rise again after a recent period of darkness, investment companies would see many competitive challenges with Stages/Foundation Fitness going forward. There’s significant competition in the power meter market, such that Stages doesn’t really the first-mover advantage they had a decade ago. And the indoor bike market is equally saturated right now, with even more competitors on the horizon. Likewise, the bike GPS/computer market is saturated with huge well-established and well-respected brands, and (also more) competitors on the horizon. It’s not a good time to enter that market either.

The second option, bankruptcy protection, is always viable for a US entity. But having laid off their entire staff, this makes it exceptionally difficult to get the business up and running again. Most entities that seek bankruptcy protection do so before the plane augers into the ground, thus leaving the business largely functional and operating. That point of no return probably happened about a year ago, at this point with losing so many key staff, and now all staff – I don’t see that as viable.

Thus leaving the last piece – being acquired by another entity. That too is challenging in this competitive environment, but, will mean that Stages likely gets acquired for cheap. Certainly, the most obvious candidate is Giant themselves. Given they manufactured many Stages products, now have the last remaining key Stages technical and executive leaders, and are owned significant sums of money from Stages – it seems like an obvious play. There are countless patents that Stages owns that would be valuable for Giant, if they are trying to spin-up some sort of new division. Certainly, Giant has shown interest in that for many years – and these recent hires are obvious confirmation of that. You don’t hire that list of names to do nothing with it.

Escape Cycling also pondered at other companies that could pick-up Stages, including SRAM. Interestingly, this wouldn’t be the first time SRAM has picked up the pieces of a defunct indoor cycling brand. They actually picked up the Velotron from CompuTrainer (RacerMate) back years ago when they went under, though seemingly haven’t done anything with it. Just like they picked up the PowerTap like from SARIS when that ship was going down, also without seemingly doing anything with it.

But in this case, I’d struggle to see the value for SRAM here. Unlike those brands, there’s substantial consumer support overhead SRAM would have to deal with by picking up Stages. Both on the end-consumer side, as well as the corporate account (gyms) side. SRAM is too visible a company in the consumer realm to simply wave their hand and say “not our problem” to existing support commitments. Further, I don’t think SRAM would really want to get into the gym or even the consumer indoor bike realm right now. Again, that peak period passes about 3-4 years ago, especially for the massively heavy products that Stages has.

Ultimately, I suspect Giant will pick up the pieces from Stages on the cheap. But whether or not they decide to provide support for existing consumers is probably the big question. Only time will tell, and at the moment, I don’t see that being a fast process. A fact that’s going to cause problems for both regular consumers and gyms alike. If you’ve got a Stages product that breaks right now, be it a bike computer, or an entire cycling studio, you’re entirely out of luck.

As with most companies, there’s a very finite time period before consumers won’t ever return to a brand due to lack of support. The clock is ticking fast on that moment.

Hopefully, for the sake of existing consumers, Stages can find a solution that gets people the support they need, and ultimately finds a future for Stages or their product portfolio.

0 Commentaires